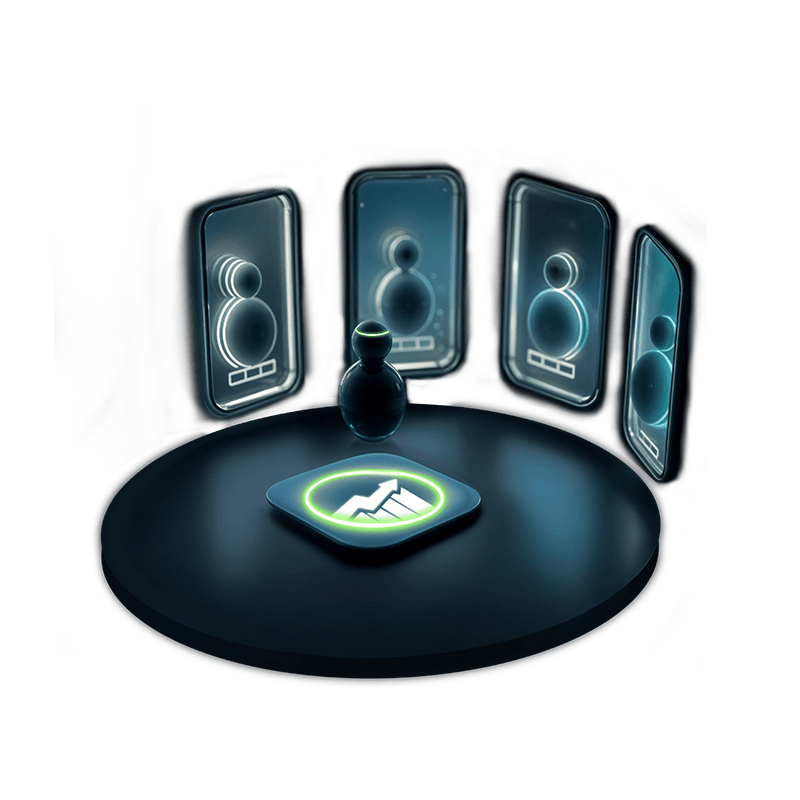

Mirror trading is a form of automated or semi-automated trading in which investors replicate the trading strategies of experienced and successful traders. In mirror trading, a follower (or investor) copies the trades made by a selected “signal provider” or “strategy provider” without the need for active involvement in the trading process. This concept is also sometimes referred to as copy trading or social trading.

Here’s how mirror trading typically works:

- Selection of Signal Provider: Investors who want to engage in mirror trading choose from a list of experienced traders or signal providers. These signal providers often have public profiles displaying their trading strategies, performance records, risk levels, and other relevant information.

- Copying Trades: Once a signal provider is selected, the investor’s trading account is linked to the provider’s account. From that point forward, the investor’s account automatically replicates the trades executed by the signal provider. This means that when the signal provider opens, modifies, or closes a trade, the same actions are mirrored in the investor’s account in real-time.

- Risk Management: Mirror trading platforms typically allow investors to set parameters for risk management. For example, they can establish the maximum amount they are willing to invest in a single trade, set stop-loss and take-profit levels, or even halt trading if specific drawdown levels are reached.

- Continuous Monitoring: Investors can monitor the performance of their mirrored trading accounts in real-time. They can view the trades, track the profit or loss, and make adjustments or disconnect from the signal provider at any time.

Advantages of Mirror Trading:

- Accessibility: Mirror trading allows individuals with limited trading knowledge to participate in financial markets by following the strategies of more experienced traders.

- Diversification: Investors can diversify their portfolios by following multiple signal providers with different trading styles and strategies.

- Time-Saving: Mirror trading eliminates the need for active day trading or constant market monitoring, making it suitable for those with busy schedules.

- Learning Opportunity: While not required, some investors use mirror trading as a way to learn from experienced traders by analyzing their strategies and decisions.

- Transparency: Most mirror trading platforms provide transparency regarding the performance and trading history of signal providers, allowing investors to make informed decisions.

However, it’s important to be aware of the potential risks associated with mirror trading:

- Risk of Loss: While mirror trading can be profitable, it also carries the risk of financial loss, especially if the selected signal provider performs poorly.

- Reliance on Others: Investors are relying on the expertise and decisions of signal providers, which may not always align with their own risk tolerance or financial goals.

- Market Risk: All trading carries inherent market risk, and mirror trading is no exception. Sudden market movements or unexpected events can lead to losses.

- Performance Variation: Past performance of signal providers is not indicative of future results. Signal providers may change their strategies or experience periods of poor performance.

- Broker and Platform Risks: The reliability and trustworthiness of the mirror trading platform and the broker chosen can impact the safety and success of mirror trading.

Before engaging in mirror trading, investors should carefully research and choose reputable signal providers, set clear risk management parameters, and consider the suitability of this approach to their investment goals and risk tolerance. Additionally, it’s advisable to start with a demo account or a small amount of capital to test the waters before committing significant funds to mirror trading.